Industry analyst Canalys expects global cloud infrastructure services spending to increase by 20%, this year to $348.5 billion worldwide – up on last year’s growth figure of 18%. The growth will be driven – as it was in 2023 – by cloud migration and new demand being generated through the adoption of AI.

► AI adoption will be a big driver for cloud growth this year

► Migration efforts are picking up again

► Top three hyperscalers claim two thirds of the market

Canalys noted that as more customers expand their commitments with hyperscalers in anticipation of increased consumption requirements, the influence of enterprise IT optimisation on the cloud services market is falling. It said that cloud migration efforts are picking up again, alongside a surge in new demand, driven by widespread adoption of AI applications. According to the firm, hyperscalers are steadily ramping up investments in generative AI, expecting that harnessing its capabilities will catalyse new opportunities in cloud consumption.

The integration of generative AI into mainstream software products is accelerating

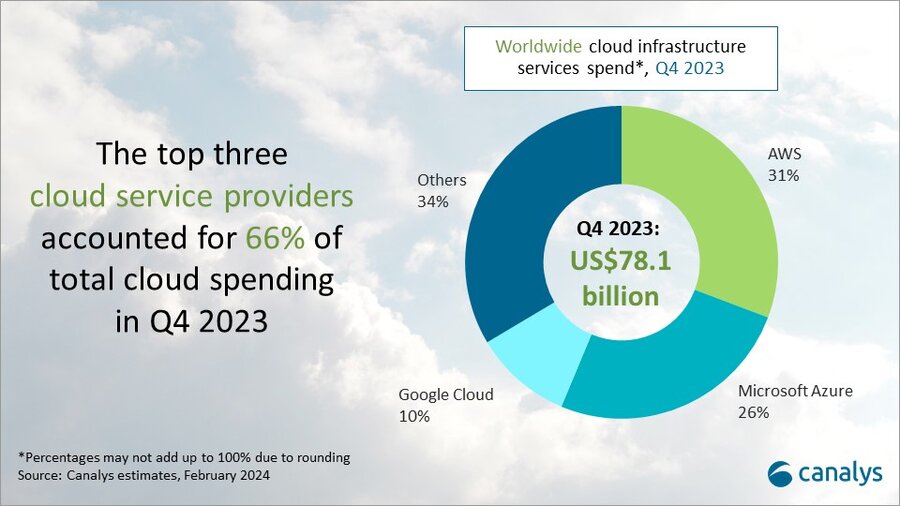

In Q4 2023, growth was slightly higher than it was the full year, at 19% year-on-year. In that period, the top three cloud providers – AWS, Microsoft Azure and Google Cloud – jointly grew by 21% and accounted for 66% of total spending.

Microsoft Azure and Google Cloud saw a strong resurgence in revenue growth in Q4, both exceeding 25%. With 30% growth, Microsoft significantly outpaced the market and continues to close the gap on AWS. Market leader AWS saw an uptick in growth compared with previous quarters, but an increase of 13% year on year remains behind the trajectory of both Microsoft Azure and Google Cloud.

‘AWS has been slower than its key competitors to make AI advances, which may explain why its growth is not accelerating as rapidly as that of Azure and GCP’, said Yi Zhang, Analyst at Canalys. ‘The integration of generative AI into mainstream software products is accelerating, potentially leading to quicker commercialisation of generative AI applications. Google recently introduced its rebranded Gemini large language model into Workspace applications, such as Gmail and Docs. At the same time, Microsoft launched Copilot for Microsoft 365 last November, embedding its generative AI platform into Word, Excel and other office applications.’

As AI continues to evolve, solution providers are exploring integration opportunities beyond vendor offerings

Alex Smith, VP at Canalys, added: ‘This trend underscores the growing importance of AI in enhancing user experiences, productivity and efficiency within software ecosystems. As AI continues to evolve, solution providers are exploring integration opportunities beyond vendor offerings, aiming to leverage AI capabilities to innovate and deliver enhanced solutions to their clients’.

Amazon Web Services (AWS) led the cloud infrastructure services market in Q4 2023, accounting for 31% of total spend. After several quarters of slowing growth, AWS saw a modest uptick in momentum, with revenue increasing by 13% year on year. As of Q4 2023, AWS’ backlog (future committed spending by customers) stood at US$155.7 billion, a year-on-year increase of over US$45 billion. The upward trajectory of AWS’ growth rate is expected to persist through 2024. It announced a reduction in AWS Marketplace listing fees for SaaS and data offerings from 13% to 3% in December 2023, which aligns with its competitors, Microsoft Azure and Google Cloud. This initiative indicates AWS’ increasing strategic focus on its marketplace as a facilitator of consumption and partner revenue rather than a standalone revenue-generating asset. AWS launched a second infrastructure region in Calgary, Canada, in December 2023, becoming the first major cloud service provider to establish an infrastructure region in Western Canada.

Microsoft Azure, as the second-largest cloud service provider, saw its market share increase to 26% in Q4 2023, against 23% in Q4 2022. The surge in AI adoption boosted Azure’s revenue by 30% compared with Q4 2022. Azure expanded its support for OpenAI’s latest models in Q4, including GPT-4 Turbo, GPT-4 with Vision and Dall-E 3. It has secured 53,000 Azure AI customers, with over a third acquired in the past 12 months. With its AI advantage, Azure’s growth momentum is expected to continue. It announced that, as of 16 January 2024, Copilot for Microsoft 365 is generally available across all sales channels. This move aims to broaden access for customers and create additional opportunities for the partners serving them.

Google Cloud was the third largest provider and grew 26% to account for 10% of the market in Q4 2023. Driven by demand for AI, Google Cloud began a new growth trajectory in Q4. As of 31 December 2023, Google Cloud accumulated US$74.1 billion in revenue backlog, up from US$64.3 billion at the end of 2022. Google hopes that its Gemini large language model will elevate it to the forefront of the artificial intelligence industry. Just two months after launch, Google announced its successor, Gemini 1.5, in February 2024, aimed at developers and enterprise users, with plans for a broader consumer launch soon after. Google Cloud has also maintained its focus on expanding channel partnerships to drive growth and has tripled the number of co-sell deals with partners since 2022.

Canalys defines cloud infrastructure services as those services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.