Despite concerns about the general economic and geopolitical climate, the European server market continued posting strong growth in the third quarter of 2022 according to data published by International Data Corporation (IDC).

► Demand expected to be robust for several quarters

► Infrastructure investment being made to support growth and energy efficiency

The server market in Western Europe (WE) grew year on year by 27.9% in Q3 2022 with the release of product shortage backlogs and digital transformation being the two major drivers. IDC said that modernisation of datacentre infrastructure had also been and will continue to be – a significant factor. As supply chain constraints continue to ease, the firm expects demand to be robust for the next few quarters.

The analyst said that despite general economic pressure, many organisations will invest in servers and other infrastructure technology to support their business growth, meet sustainability commitments, and increase energy efficiency in their data centres. Currently, cloud service providers and key verticals as retail, automotive, and oil and gas are the leading sectors for infrastructure investment.

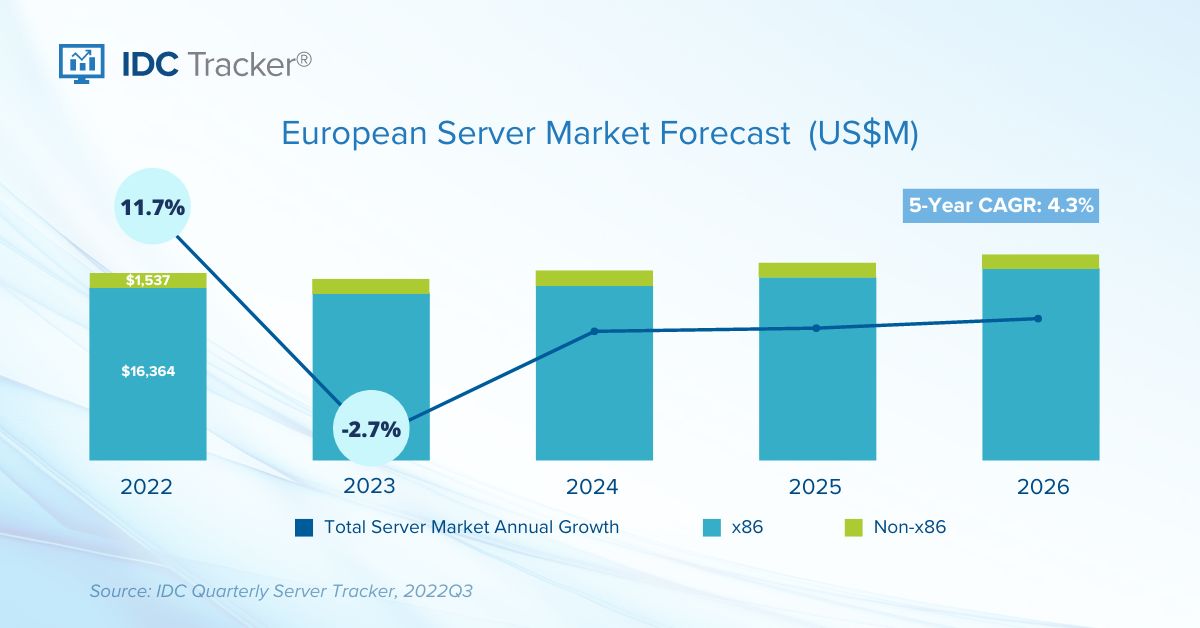

Server market spending is expected to see a five-year compound annual growth rate (CAGR) of 4.3%. The macroeconomic environment will continue to be a key factor in the short term. In the longer term, continuous investments in infrastructure modernisation, fast-growing workloads like AI/ML, and cloud and edge deployments will drive growth.