The PC market gathered momentum in Q2 2024, with worldwide shipments of desktops and notebooks up 3.4% year-on-year, reaching 62.8 million units. Shipments of notebooks (including mobile workstations) hit 50 million units, growing 4%. Desktops (including desktop workstations), which constitute 20% of the total PC market, grew 1% to 12.8 million units. The stage is now set for accelerated growth as the refresh cycle driven by the Windows 11 transition and AI PC adoption ramps up over the next four quarters.

► Stage set for accelerated growth over the rest of the year

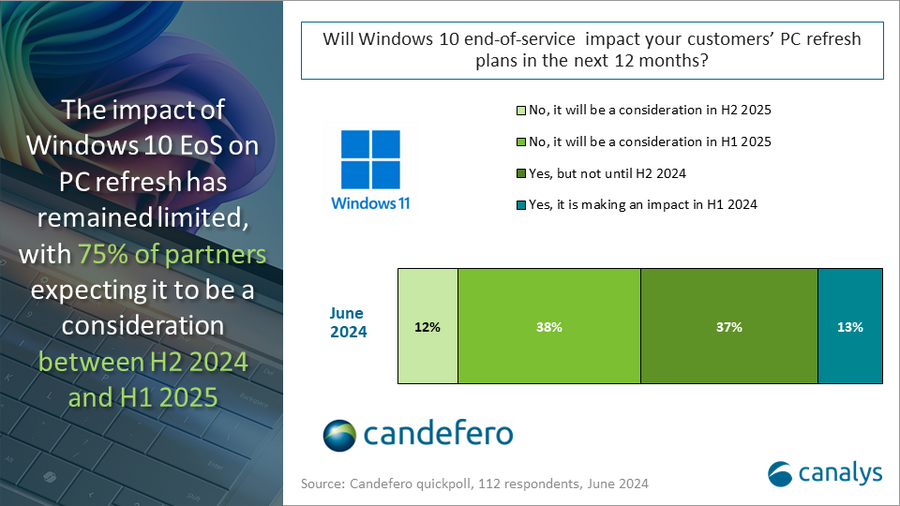

► Windows 10 end-of-life is likely to impact customer refresh plans

‘The PC industry is going from strength to strength with a third consecutive quarter of growth’, said Ishan Dutt, principal analyst at Canalys. The turnaround coincides as AI PCs begin to arrive on the market. Q2 2024 culminated with the launch of the first Copilot+ PCs powered by Snapdragon processors and the announcement of the Apple Intelligence suite of features for Mac, iPad and iPhone.

‘Beyond these innovations, the market will start to benefit even more from its biggest tailwind - a ramp-up in PC demand driven by the Windows 11 refresh cycle’, said Dutt. Channel partners surveyed by Canalys in June said that Windows 10 end-of-life is likely to impact customer refresh plans most, either in the second half of 2024 or the first half of 2025.

Lenovo maintained its position as the market leader in the global PC market, growing shipments 4% to 14.7 million units. HP followed closely on 13.7 million units, with Dell third on 10.1 million units. Apple shipments were 5.5 million units – up 6% on last year. Asus rounded out the top five, overtaking Acer, thanks to the success of its gaming PCs. Asus experienced the highest growth in Q2 2024, with a 17% annual increase, shipping 4.5 million units.

Worldwide desktop and notebook shipments (market share and annual growth)

Canalys PC Market Pulse: Q2 2024

| Vendor | Q2 2024 shipments | Q2 2024 market share | Q2 2023 shipments | Q2 2023 market share | Annual growth |

|---|---|---|---|---|---|

| Lenovo | 14,724 | 23.40% | 14,230 | 23.40% | 3.50% |

| HP | 13,681 | 21.80% | 13,444 | 22.10% | 1.80% |

| Dell | 10,078 | 16.00% | 10,329 | 17.00% | -2.40% |

| Apple | 5,510 | 8.80% | 5,198 | 8.60% | 6.00% |

| Asus | 4,535 | 7.20% | 3,865 | 6.40% | 17.30% |

| Others | 14,280 | 22.70% | 13,669 | 22.50% | 4.50% |

| Total | 62,809 | 100.00% | 60,736 | 100.00% | 3.40% |

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding.

Source: Canalys PC Analysis (sell-in shipments), July 2024