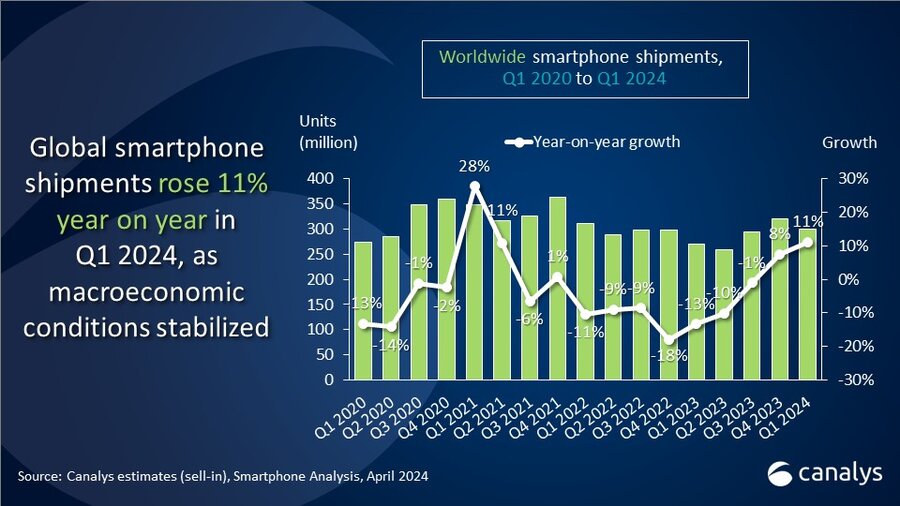

According to Canalys’ latest research, worldwide smartphone shipments grew 11% year-on-year in the first quarter of 2024 as consumer demand picked up along with the global macroeconomic recovery.

► Positive start to 2024 as premium products and AI boost sales

► Apple AI-driven device expected to provide further impetus

‘The worldwide smartphone market started the year on a positive note, marking a significant improvement on the same period last year,’ said Canalys Analyst Le Xuan Chiew. ‘Q1 2023 struggled due to a sluggish economy and inflationary pressures. But with the economy stabilising, new product launches and strong promotional efforts, the market has rebounded, offering smartphone vendors an excellent opportunity to revitalise growth.

‘Vendors are seizing new opportunities by promoting premium offerings that set them apart, such as cutting-edge AI features and services on flagship products and using ecosystem-based product strategies. All eyes are on Apple in 2024, which is highly likely to make an AI announcement that would provide opportunities for the brand to drive its premium offerings and reignite product innovation across its ecosystem.’

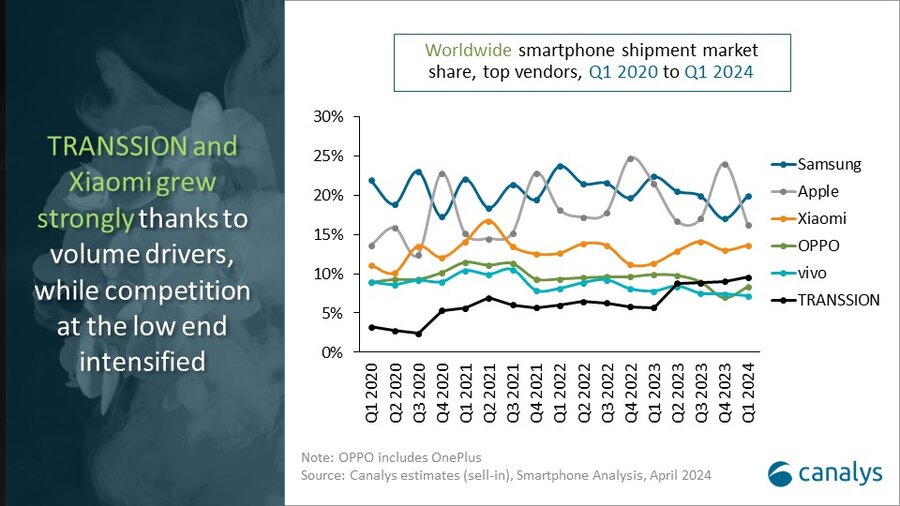

Samsung regained the top spot with a 20% share, driven by positive sentiment from the introduction of Galaxy AI. Apple came second with a 16% market share, facing headwinds in strategic markets. Xiaomi took third place, boasting a 14% market share as its competitive volume driver, the newly launched Redmi A3, gained traction. TRANSSION held fourth place with a 10% share, while OPPO completed the top five with 8%.

“Despite an upbeat market, it is vital that smartphone vendors keep a watchful eye on inventory levels,” said Canalys Research Analyst Lucas Zhong. “With uncertain global inflationary conditions, vendors are exercising caution in inventory management to mitigate the risk of oversupply and ensure financial stability. Anticipating a slight inventory correction in the second quarter of 2024, the channel aims to digest the aggressive shipments of past quarters, making room for new launches later in the year to bring about more sustainable longer-term growth.”

Worldwide smartphone market share split

Canalys Preliminary Smartphone Market Pulse: Q1 2024

| Vendor | Q1 2024 market share | Q1 2023 market share |

|---|---|---|

| Samsung | 20% | 22% |

| Apple | 16% | 21% |

| Xiaomi | 14% | 11% |

| TRANSSION | 10% | 6% |

| OPPO | 8% | 10% |

| Others | 33% | 29% |

Preliminary estimates are subject to change on final release.

Note: percentages may not add up to 100% due to rounding. OPPO includes OnePlus.

Xiaomi estimates include sub-brand POCO. TRANSSION includes Tecno, Infinix and iTel.

Source: Canalys estimates (sell-in shipments), Smartphone Analysis, April 2024