Worldwide spending on security solutions and services is forecast to be $219 billion in 2023, an increase of 12.1% compared to 2022, according to IDC. Investments in hardware, software, and services related to cybersecurity are expected to reach nearly $300 billion in 2026, driven by the ongoing threat of cyberattacks, the demands of providing a secure hybrid work environment, and the need to meet data privacy and governance requirements.

Spend on security will continue to outperform growth in overall IT sales. The largest investments will be made in the banking, manufacturing, professional services, and central government markets. These four sectors will account for more than a third of all security spending in 2023. According to IDC, in banking, manufacturing and government the largest proportion of spend will be on managed security services. In the professional market there will be more emphasis on software with a focus on governance, risk, compliance and endpoint security.

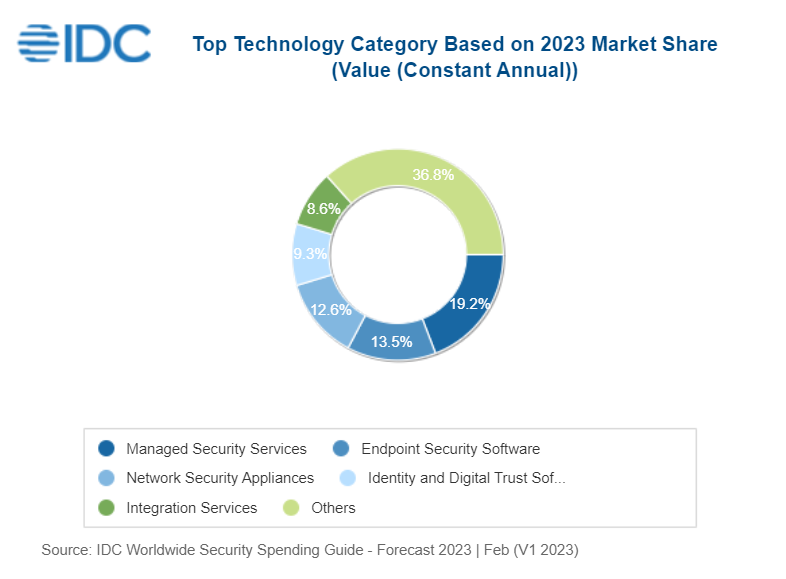

Software will generate the largest proportion of business, representing nearly half of all security spending this year, with endpoint security the biggest category, followed by identity and digital trust software and cybersecurity analytics, intelligence, response, and orchestration software.

Services will be the second largest technology group, led by the managed security services category with $42 billion in spending expected this year. Hardware spending will be dominated by network security appliances. Software will be the fastest growing of the three technology groups with a five-year compound annual growth rate of 13.7%, followed by Services at 11.0%.

After the US, Western Europe will be the largest region for security spending and is expected to grow at more than 10% over the forecast period. IDC noted that services will be the major areas of focus here, due to organisations having limited competences in security and the need to raise protection against ransomware attacks. The top IT security spending sectors in Europe will be finance – which will also have to constantly ensure regulatory adherence – and manufacturing - which will need to defend against increasingly frequent cyberattacks on production plants.

The figures come from IDC’s Worldwide Security Spending Guide.