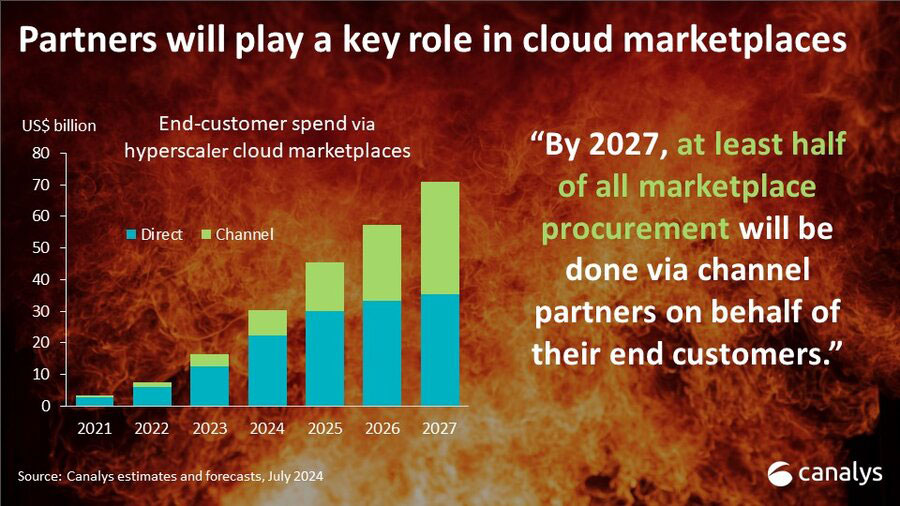

Enterprise software sales through hyperscaler cloud marketplaces – led by AWS, Microsoft and Google Cloud – are projected to reach $85 billion by 2028, rising from US$16 billion in 2023, according to figures from Canalys. Critically, the analyst expects more and more business to go through channel partners as hyperscalers grow.

► At least half of all sales to go via channel by 2027

► Distributors to play vital role as aggregators

The availability of cloud credits for third-party purchases through the hyperscalers’ marketplaces and the emergence of new ‘digital-first’ buyers are reshaping enterprise customer procurement behaviour, vendor sales strategies and channel models. While most vendor sales via these marketplaces are today direct to end customers, channel partners are playing an increasingly important role. By 2027, Canalys expects more than 50% of marketplace sales to flow through the channel.

Enterprise customers have committed to spend over $360 billion on the top three hyperscalers’ cloud services on a multi-year basis. Spend is shifting to the hyperscalers’ marketplaces as customers seek to burn down a portion of their cloud credits on third-party software and SaaS.

AWS Marketplace remains the clear leader in terms of sales volume, but Microsoft and Google Cloud are focused on closing the gap. With enterprises facing IT budget pressure, the opportunity to use pre-approved cloud budgets to source a wide array of software and cybersecurity products, while taking advantage of simplified billing and consolidated purchasing can be highly compelling.

While the popularity of these platforms is growing, Canalys pointed out that IT distributors will continue to provide an important way for hyperscalers and partners to reduce operational challenges especially as the number of ‘second-tier’ partners whose customers want to buy this way grows. Canalys expects the development and expansion of new programmes to support greater distributor involvement.