Spending on compute and storage infrastructure products for cloud deployments increased 18.5% year-over-year in the fourth quarter of 2023 to $31.8 billion, according to IDC. This segment of the market is now close to double the size of the non-cloud segment, which increased by 16.4% in Q4 of 2023 to $18.9 billion.

► Shared cloud infrastructure spending up 27%

► AI investment drives higher ASPs

► Overall cloud infrastructure growth will be 20% in 2024

The figures for the cloud deployments include both shared and dedicated IT environments, with the former far eclipsing the latter. Spending on shared cloud infrastructure reached $22.8 billion in the quarter, up 27.0% YoY, while the dedicated cloud infrastructure segment saw only modest growth of 1.4% and generated a mere $9.0 billion worldwide.

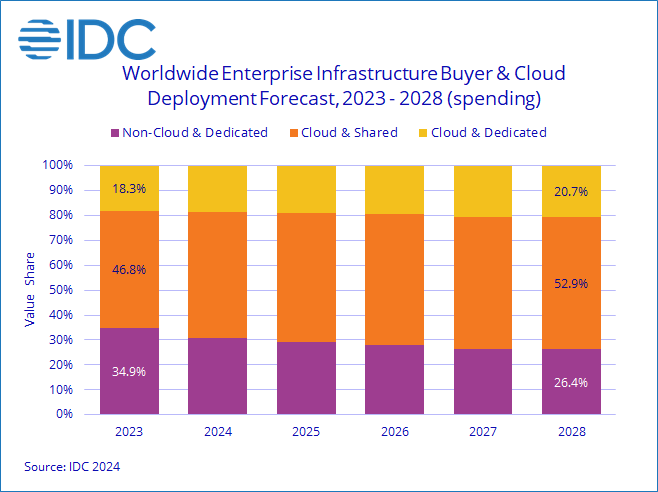

For 2024, IDC is forecasting cloud infrastructure spending to grow 19.3% to $129.9 billion. Non-cloud infrastructure is expected to decline 1.4% to $57.6 billion. Shared cloud infrastructure is expected to grow 21.6% year over year to $95.3 billion for the full year while spending on dedicated cloud infrastructure is expected to see robust growth of 13.3% in 2024 to $34.6 billion for the full year.

IDC noted that a key reason for the positive outlook on cloud spending is that due to the mission-critical nature of the workloads being deployed on them, cloud infrastructures often require higher-end, performance-oriented systems. Evidence of this could be seen in the Q4 2023 figures which showed that while the spending was up significantly, unit shipments of hardware for use in cloud infrastructure declined by 22.8%. This dichotomy was due to an increase in average selling prices (ASPs) related to higher-than-usual GPU server shipments to hyperscalers and AI-related investments.

Juan Pablo Seminara, research director, worldwide enterprise infrastructure trackers at IDC, stated: ‘Cloud infrastructure spending continues to accelerate towards more robust configurations, mainly fuelled by the explosion of AI-related investments. Even though some caution remains on the socio-political side, the improvement in economic prospects contribute to a very positive spending outlook for 2024 and 2025 where cloud-based spending is expected to rebound at double-digit growth rates.’